01Simple To Use

Choose how much you want to invest and decide how much risk you want to take and set up an online account

02Managed By Experts

These investments are run by an experienced team using tried and tested strategies

03Competitive Fees

Our fees are simple, transparent and competitive

- Low Risk

- Low to Medium Risk

- Medium Risk

- Medium to High Risk

- High Risk

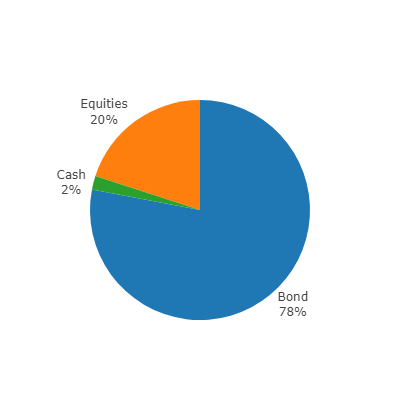

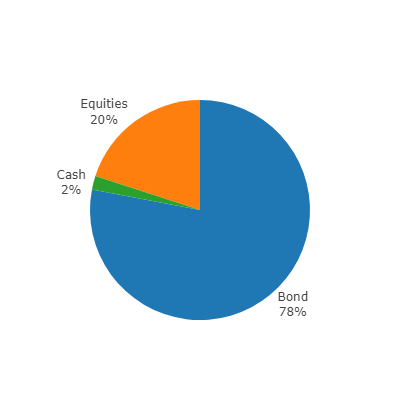

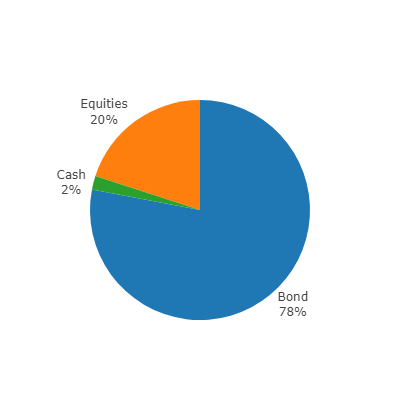

Low risk

Fund 1

This fund provides the lowest-risk fund in the range, emphasising low-risk assets like bonds. The long-term asset mix is 80% Bonds, 18% Equity and 2% Cash.

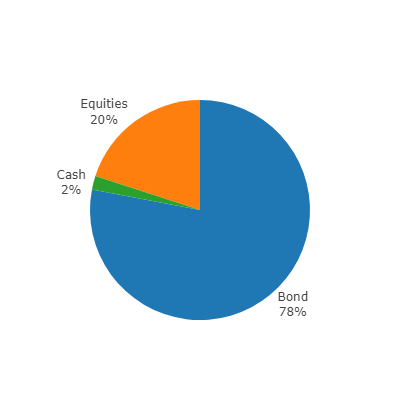

Low to Medium Risk

Fund 2

As the risk increases, the amount invested in lower risk investments, such as bonds reduces to 50%. As a result, the long term asset mix is 60% Bonds, 38% Equity and 2% Cash.

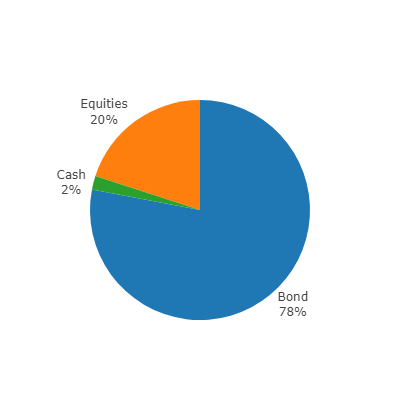

Medium Risk

Fund 3

The medium-risk fund has an increasing exposure to higher risk investments, such as equities, with at least 45% of its fund value in equities. The long-term asset mix is 44% Bonds, 54% Equity and 2% Cash.

Medium to High Risk

Fund 4

The exposure to funds increases with this medium to high-risk fund investing at least 65% of its value in equities. The long-term asset mix comprises 24% Bonds, 74% Equity and 2% Cash.

High Risk

Fund 5

This fund has the greatest emphasis on equities, representing at least 90% of its value. As the risk profile increases, so does the larger return or capital loss. The asset mix is 98% Equity and 2% Cash.

What It Costs

| Fee | Detail | Amount |

| Initial Charge | To cover the cost of undertaking onboarding and allocating funds to the chosen investment. | 1% of the value of your investment |

| An ongoing charge | The annual cost to cover the cost of managing your investment | 0.50% of the value of your investments over a year |

| Platform fee, every three months | To cover the cost of administration and online access to your BriceAmery Invest account | 0.15% of the value of your investments over a year |

| Transaction costs | The cost of buying and selling shares and other investments that make up the fund. The fund manager will deduct these costs from the fund’s assets | 0.07% of the value of your investments |

Why Invest Online With BriceAmery?

With many types of mortgages and interest rates on the market, it can be confusing to know which one is right for you, so we’ve outlined some of the basic below.

How it works

Are You Eligible?

ul li{padding-bottom:8px}

- Aged 18 or over

- Already a user of BriceAmery Online

- Will hold you investment for a minimum of one year

- Can be categorised as a Professional Investors or Market Counterparty, we do not serve Retail Investors.

- Fees and charges apply.

- Full Terms & Conditions are available from your relationship manager.

- The value of investments and their income can go up and down, and you may not recover the amount of your original investment.

- Tax reliefs referred to are those applying under current legislation, which may change. Therefore, the availability and value of any tax reliefs will depend on your circumstances.

- It is important to know that our non-advised service through BriceAmery Invest does not provide investment advice or recommendations. The value of investments can go up as well as down, so you could get back less than you invest. Your capital is at risk. If you are unsure about an investment, you may wish to seek personal financial advice.

- If you have higher priority needs you should discuss this with the relationship manager before making an investment.